23street.ru

Community

Quick Ways To Borrow Money

Banks offer a variety of ways to borrow money, including mortgage products, personal loans, auto loans, and construction loans. They also offer opportunities. How to save money on a tight budget with Set & Save. Oportun logo icon. Get quick access to funds so you can focus on what matters, instead of how to. Need extra cash? Borrow money online from Speedy Cash today! Apply for one of our online loans and receive your funds within 30 minutes! EarnIn is a fintech company that offers the largest cash advance on our list. You can borrow up to $ each pay period. However, the maximum amount you can. The fastest way to borrow money is to go to a pawn shop, They will take almost anything, (how much you can get though will depend on the. A fast cash loan allows you to get the cash you need – quick. These loans typically have a shorter term than traditional bank loans. You can normally get these. We offer online Cash Advance loans in Canada. Apply today and borrow $ to $ in two hours with our easy application. Borrow up to $ instantly*^ even with bad or no credit. Receive your money quickly, improve your financial health, and gain peace of mind. Borrow Money Online and get a payday loans the same day, You can borrow up to $, quickly and easily, without having to go though a credit check. Banks offer a variety of ways to borrow money, including mortgage products, personal loans, auto loans, and construction loans. They also offer opportunities. How to save money on a tight budget with Set & Save. Oportun logo icon. Get quick access to funds so you can focus on what matters, instead of how to. Need extra cash? Borrow money online from Speedy Cash today! Apply for one of our online loans and receive your funds within 30 minutes! EarnIn is a fintech company that offers the largest cash advance on our list. You can borrow up to $ each pay period. However, the maximum amount you can. The fastest way to borrow money is to go to a pawn shop, They will take almost anything, (how much you can get though will depend on the. A fast cash loan allows you to get the cash you need – quick. These loans typically have a shorter term than traditional bank loans. You can normally get these. We offer online Cash Advance loans in Canada. Apply today and borrow $ to $ in two hours with our easy application. Borrow up to $ instantly*^ even with bad or no credit. Receive your money quickly, improve your financial health, and gain peace of mind. Borrow Money Online and get a payday loans the same day, You can borrow up to $, quickly and easily, without having to go though a credit check.

There are several apps that offer quick personal loans in India. Notable among them is Kotak Mahindra Bank's mobile app. Through this app, users. If you own something valuable like a diamond necklace or power tool, you can walk into a pawn shop and borrow money right away. Most pawn shops will provide a. The higher your credit score, the more you may be able to borrow and the lower the interest rate you could receive. You most likely have money left over for. Get fast access to funds with our streamlined personal loan process for quick financing when you need it How to use your f1RST ® Quick Loan. Banks offer a variety of ways to borrow money, including mortgage products, personal loans, auto loans, and construction loans. They also offer opportunities. How to save money on a tight budget with Set & Save. Oportun logo icon. Get quick access to funds so you can focus on what matters, instead of how to. 9 Ways to Borrow Money · 1. Personal Loan from a Bank or Credit Union · 2. 0% APR Credit Cards · 3. Buy Now, Pay Later · 4. Personal Lines of Credit · 5. (k). What is a line of credit and how does it work? Answer: A line of credit is money you can borrow on an ongoing basis. With a line of credit, you can have. Drafty's line of credit is a way of borrowing, but without the hassle that you often get from other lenders. It's quick, simple, and you stay in control. Can I. Try Viva Payday Loans. They have an easy online application that connects you with various lenders. You can borrow between $ and $5,, with. Get an Instant Cash advance*, build credit**, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health. One option is to use a service like Ace Cash Express, which can provide you with the money you need within minutes. Another option is to take. While paying cash for expenses is the cheapest option, sometimes we need to borrow money. So what is the best way to borrow money online and fast? Whether you. Smart ways to borrow money · 7 tips for smart borrowing · 1. Know your numbers. · 2. Differentiate between “good” and “bad” debt. · 3. Stick with lenders you trust. How much you can borrow with a same-day loan and how much it costs are determined by factors including state regulation, your ability to pay, and other. EarnIn is a fintech company that offers the largest cash advance on our list. You can borrow up to $ each pay period. However, the maximum amount you can. Drafty's line of credit is a way of borrowing, but without the hassle that you often get from other lenders. It's quick, simple, and you stay in control. Can I. An instant personal loan works in the same way as a standard personal loan. You can apply online for this type of loan, and your lender will perform a credit. Spotloan is a better way to borrow extra money. It's not a payday loan. It's an installment loan, which means you pay down the balance with each on-time.

Best Way To Cash Out 401k Early

Depending on the amount you withdraw and where you live, you may need to pay state or local taxes as well. If you tap into your (k) before you reach age 59½. Penalties for Cashing Out Your (k) Early · distributions to an employee who is 55 or older and no longer works for the employer sponsoring the plan. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. Also, depending on the type of plan the funds are withdrawn from, you may have a 10% penalty tax as well ( plans are not subject to the 10% early withdrawal. early withdrawal penalty. Qualified birth or adoption Distribution up to A wire transfer is an easy, convenient way to send money to people you know. Some types of retirement plans (like s), do allow for “early” withdrawals. If you leave your job or retire, you may be able to withdraw funds without penalty. Avoid tax penalties when using your (k) before retirement by taking a hardship distribution or a loan from your plan. Plus: learn ways to minimize the. Avoid the (k) early withdrawal penalty. · Shop around for low-cost funds. · Read your (k) fee disclosure statement. · Don't leave a job before you vest in. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Depending on the amount you withdraw and where you live, you may need to pay state or local taxes as well. If you tap into your (k) before you reach age 59½. Penalties for Cashing Out Your (k) Early · distributions to an employee who is 55 or older and no longer works for the employer sponsoring the plan. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. Also, depending on the type of plan the funds are withdrawn from, you may have a 10% penalty tax as well ( plans are not subject to the 10% early withdrawal. early withdrawal penalty. Qualified birth or adoption Distribution up to A wire transfer is an easy, convenient way to send money to people you know. Some types of retirement plans (like s), do allow for “early” withdrawals. If you leave your job or retire, you may be able to withdraw funds without penalty. Avoid tax penalties when using your (k) before retirement by taking a hardship distribution or a loan from your plan. Plus: learn ways to minimize the. Avoid the (k) early withdrawal penalty. · Shop around for low-cost funds. · Read your (k) fee disclosure statement. · Don't leave a job before you vest in. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a.

Substantially Equal Period Payments. Substantially equal period payments (or 72(t) SEPPs) can also be a good option to rely on when you need to cash out some. Verify with your employer's HR department whether early withdrawals are allowed under your plan, as not all plans permit this option. When you need extra money. What is the cost if I withdraw my (k) early? The typical early withdrawal penalty is 10%. This 10% is on top of income taxes you pay on the withdrawal. Because retirement funds are meant to provide you income in retirement, the IRS has specific rules in place to discourage you from withdrawing your money early. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. The money in other retirement plans must remain in. You'll pay income taxes when making a hardship withdrawal and potentially the 10% early withdrawal fee if you withdraw before age 59½. However, the 10% penalty. Individuals must pay an additional 10% early withdrawal tax unless an exception applies. ((k), etc.) IRA, SEP, SIMPLE IRA* and SARSEP plans, Internal. A Roth IRA allows you to withdraw your contributions at any time—for any reason—without penalty or taxes. For example: If you contributed $12, over 2 years. Visualize the impact on your long-term retirement savings of withdrawing money from your retirement accounts prior to retirement if you are considering. Ask yourself honestly are you tempted to cash out your k early? You probably have a long list of all the great things you can do with those funds right. It's still not a good idea, but less bad than a full withdraw as the full withdraw comes with taxes as income plus a 10% penalty for the early. You can withdraw money from a (k) before you retire, but you could end up paying extra taxes and fees. Here's some more information about how early (k). Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your (k). If you really need to use the money in your retirement account before you're 59½, Meilahn suggests taking out a (k) loan instead of taking an early. However, when you take an early withdrawal from a (k), you could lose a significant portion of your retirement money right from the start. Income taxes, a The only other way to get access to your funds is to leave your employer. Disadvantages of Closing Your k. The IRS allows individuals to cash out their k. Twenty percent is withheld for federal income taxes. You can also roll money from your (k) to IRA or other qualified plan. Funds that are rolled over are not. With a (k) loan, you borrow money from your employer retirement plan and pay it back over time. (Employers aren't required to allow loans, and some may limit. As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. You can take money out before you reach that age. However, an early withdrawal generally means you'll have a 10% additional tax penalty unless you meet one of.

What Is The Accounting Equation

:max_bytes(150000):strip_icc()/Accounting-Equation-9f2308e5c1f24bb1a5a2a65c35a22556.png)

The accounting equation may be expressed in three different forms: The first format is the fundamental accounting equation used in financial reporting. The accounting equation: assets = liabilities + owner equity. The accounting equation states that the value of a company's assets is equal to the sum of the company's liabilities and equity. The expanded accounting equation breaks down shareholder's equity (otherwise known as owners' equity) into more depth than the fundamental accounting equation. Accounting Equation in Layman's Terms. The accounting equation is calculated as follows: assets=liabilities + capital, where capital equals either stockholder. A double-entry accounting system is based on the accounting equation: Total Assets = Liabilities + Equity. The equation is expressed as: Assets = Liabilities + Equity. In other words, everything a company owns (assets) must be financed either through debt . This equation represents the relationship between the resources a company owns (assets), the amounts it owes to others (liabilities), and the residual interest. The accounting equation states that the value of a company's assets is equal to the sum of the company's liabilities and equity. The accounting equation may be expressed in three different forms: The first format is the fundamental accounting equation used in financial reporting. The accounting equation: assets = liabilities + owner equity. The accounting equation states that the value of a company's assets is equal to the sum of the company's liabilities and equity. The expanded accounting equation breaks down shareholder's equity (otherwise known as owners' equity) into more depth than the fundamental accounting equation. Accounting Equation in Layman's Terms. The accounting equation is calculated as follows: assets=liabilities + capital, where capital equals either stockholder. A double-entry accounting system is based on the accounting equation: Total Assets = Liabilities + Equity. The equation is expressed as: Assets = Liabilities + Equity. In other words, everything a company owns (assets) must be financed either through debt . This equation represents the relationship between the resources a company owns (assets), the amounts it owes to others (liabilities), and the residual interest. The accounting equation states that the value of a company's assets is equal to the sum of the company's liabilities and equity.

The accounting formula is a representation of a business' finances in the form of assets, liabilities and owners' equity. An easier way to explain the equation to newbies is E = A - L. The value of equity ie the value of the company is what you own minus what you owe. A mathematical equation underlies the entire accounting process. Known as the fundamental accounting equation, it states: Assets = Liabilities + Shareholders'. The accounting equation is a fundamental concept in accounting that states that all assets of a business are equal to the sum of its liabilities and equity. The basic equation of accounting is Assets = Liabilities + Owner's Equity. where: liabilities are all current and long-term debts and obligations. The equation must always be balanced, meaning that the aggregate value of the entity's assets must be equivalent to the total of its liabilities plus owner's. The accounting equation is the backbone of the accounting and reporting system. It is central to understanding a key financial statement known as the balance. The accounting equation · Assets = Capital + Liabilities · Assets = Capital introduced + (Income – Expenses) – Drawings + Liabilities · Example Anushka began a. Our Explanation of Accounting Equation (or bookkeeping equation) illustrates how the double-entry system keeps the accounting equation in balance. For Example: If Assets = $50, and Liabilities = $18,, what is the amount of Equity? Using the Accounting Equation, plug in the. Accounting equation · Owner's equity = Contributed Capital + Retained Earnings · Retained Earnings = Net Income − Dividends · Net Income = Revenue − Expenses. The accounting equation of a sole proprietorship is assets = liabilities + owner's equity. Financial Health Assessment: The Accounting Equation provides a snapshot of a company's financial position, allowing businesses to assess their overall. Assets equals liabilities plus equity is the foundational formula in accounting. It helps establish the net worth (and solvency) of a business. Accounting Equation: The accounting equation is a basic principle of accounting and a basic element of the balance sheet. Students can download BYJU'S to. The accounting equation posits that the total assets of a company are equal to the sum of its liabilities and shareholders' equity. The accounting equation is used to capture the economic effects of financial activities in a business: Assets = Liabilities + Owner's Equity. The basic accounting equation formula is: total Assets = Liabilities + Equity. It is used in Double-Entry Accounting to record transactions. Accounting equation is a track of whether the company's assets equal its liabilities plus the owner's or shareholder's equity. Assets (A) and expenses (E) are on the left side of the equation representing debit balances. The double-entry rule is thus: if a transaction increases an asset.

How Can Big Data Improve Customer Experience

Data analytics has paved the way for personalized customer experiences by analyzing vast datasets to extract meaningful patterns. Data can help them with many things, but most importantly, it can help them identify new business opportunities which can generate more sales and create a. By analysing vast amounts of data, companies can personalise their offerings, predict customer behaviour, identify pain points, and streamline operations. Quality customer service is the gateway to long-term relationships. By using advanced data analytics you can understand your consumer base, deliver on or. By observing behavior patterns or doing sentiment analysis, you can find out why buyers act in a certain way without asking them explicitly. CRM (customer relationship management) combined with Big Data is the practice of integrating big data into internal business processes with the aim of. How does data analytics help enhance customer experience? · Create a personalised marketing experience · Predict customer demands · Enhance customer service. The value of big data is not its size -it is that it can offer new kinds of information to study -information that has never previously been collected (Stephens. According to McKinsey, personalization can increase revenue by % and marketing efficiency by %. Big Data analytics allows brands to use online behavior. Data analytics has paved the way for personalized customer experiences by analyzing vast datasets to extract meaningful patterns. Data can help them with many things, but most importantly, it can help them identify new business opportunities which can generate more sales and create a. By analysing vast amounts of data, companies can personalise their offerings, predict customer behaviour, identify pain points, and streamline operations. Quality customer service is the gateway to long-term relationships. By using advanced data analytics you can understand your consumer base, deliver on or. By observing behavior patterns or doing sentiment analysis, you can find out why buyers act in a certain way without asking them explicitly. CRM (customer relationship management) combined with Big Data is the practice of integrating big data into internal business processes with the aim of. How does data analytics help enhance customer experience? · Create a personalised marketing experience · Predict customer demands · Enhance customer service. The value of big data is not its size -it is that it can offer new kinds of information to study -information that has never previously been collected (Stephens. According to McKinsey, personalization can increase revenue by % and marketing efficiency by %. Big Data analytics allows brands to use online behavior.

Meanwhile, technology is expected to work flawlessly, and applications are presumed to have interoperability. So, how can big data improve customer experiences? There are seven ways effectively implementing big data with volume, variety and velocity will help your business. By collecting and analyzing customer data, companies can gain insights into customer behavior and preferences, and deliver personalized, relevant experiences. Forrester published a study on marketing performance as it relates to customer experience. They found that big data represents a way for companies to reach. Big data can help businesses understand how customers choose to engage, who they are, and what they want. From the marketing perspective, it can help you recognize certain customer attributes, such as the frequency of purchases and, in some cases, budgets. Generally. Unstructured data will likely require big data technology, operations and management. The integration of structured and unstructured data will require. CRM (customer relationship management) combined with Big Data is the practice of integrating big data into internal business processes with the aim of. Businesses gain significant customer insights into customer behaviour, experience and emotions through Big Data Analytics and can use it to scale up. Q9: What are some of the most impactful strategies or analytical tactics that brands should test? Q How does a brand get started leveraging big data to. It tracks consumer behavior. · It offers opportunity for a more personalized customer experience. · It turns social media into a power tool for better customer. Data analytics can help companies improve customer experience from various sides, such as personalisation, demand prediction, and customer service. 5 Ways Big Data Can Improve the Customer Experience · Identify the metrics that need improvement in the contact center · Understand customer sentiments to. This is where big data analysis comes into play. By harnessing the power of big data, businesses can gain valuable insights into their customers' preferences. Big data can offer more than insights on customer wants, however. Using big data analytics, hoteliers can anticipate guest needs based on factors including the. Adopting a hyper-personalized marketing strategy powered by data, analytics, and AI will give you the insights and capabilities to adapt to your customers'. Offering multiple channels for support – part of your omnichannel approach · Optimizing wait and response times – which could mean a strategy that mixes digital. Having a deeper understanding of customer behavior leads to identifying trends and patterns that can help companies improve the impact of sales, marketing. Big Data Analytics can significantly improve customer service by enabling businesses to better understand customer behavior, preferences. When utilized effectively, BDA can help refine business processes, develop initiatives, identify flaws or roadblocks, streamline supply chains.

Can Any Car Be Leased

Leasing a car means you'll have lower monthly payments and you can typically drive a vehicle that may be more expensive than you could afford to buy. Leasing a car online may allow you the benefits of uploading and signing necessary documentation from home and potentially having your car delivered to your. A car lease allows you to drive a vehicle from a dealership for an agreed upon amount of time and miles, and pay for its usage rather than for the full. Used car leasing is possible, but there are some important caveats to be aware of before you pursue this option in the Twin Cities. Get all the details you. Learning your rights and reviewing important tips and advice before entering a dealership is one of the best things you can do to protect yourself. Yes, you can lease a used car. This type of 'used car leasing' is a little known 'secret' among car dealers but most do offer Certified Pre-Owned leasing. The typical auto lease term is months. Leases can be structured to include a down payment or even with zero money down. Yes, you actually can lease a used car. This type of 'used car leasing' is a little known 'secret' among auto dealership but most dealers do offer Certified Pre. A car lease allows you to drive a vehicle from a dealership for an agreed upon amount of time and miles, and pay for its usage rather than for the full. Leasing a car means you'll have lower monthly payments and you can typically drive a vehicle that may be more expensive than you could afford to buy. Leasing a car online may allow you the benefits of uploading and signing necessary documentation from home and potentially having your car delivered to your. A car lease allows you to drive a vehicle from a dealership for an agreed upon amount of time and miles, and pay for its usage rather than for the full. Used car leasing is possible, but there are some important caveats to be aware of before you pursue this option in the Twin Cities. Get all the details you. Learning your rights and reviewing important tips and advice before entering a dealership is one of the best things you can do to protect yourself. Yes, you can lease a used car. This type of 'used car leasing' is a little known 'secret' among car dealers but most do offer Certified Pre-Owned leasing. The typical auto lease term is months. Leases can be structured to include a down payment or even with zero money down. Yes, you actually can lease a used car. This type of 'used car leasing' is a little known 'secret' among auto dealership but most dealers do offer Certified Pre. A car lease allows you to drive a vehicle from a dealership for an agreed upon amount of time and miles, and pay for its usage rather than for the full.

If you lease a car, you do not own it. You get to use it but must return it at the end of the lease unless you choose to buy it. If you buy a car, you own. You pay the dealer monthly payments much like renting a house or apartment. You do not gain ownership of the car and you must return the car, or buy it from the. Leasing a vehicle also means you don't have to deal with the unreliability and repairs associated with an aging vehicle. A typical three year lease includes a. While many people take out a car loan to finance a car, leasing offers another way to have a new car in your driveway. Leasing can allow buyers to acquire a. The answer is that you can lease the car either way. No problem. However, you will likely not be able to negotiate the price of the vehicle if you order. Typically, leasing offers lower monthly payments and lower upfront cost, and keeps you in an updated vehicle. If you're interested in more information on the. The most common type of leasing is through a dealership. You can also lease a car directly from the manufacturer or a third-party lender. Dealership Leasing. A. Leasing a vehicle is essentially entering into a long term rental agreement for that vehicle. Unlike a traditional car purchase, you don't actually own the. In contrast, when a consumer returns his or her leased vehicle, he or she has nothing to trade in towards the cost of a new lease or purchase. What can you. With a lease, you may pay less cash up front and enjoy lower monthly payments than you would if you were financing your vehicle. The answer is that you can lease the car either way. No problem. However, you will likely not be able to negotiate the price of the vehicle if you order. Can you lease a used car? Easterns has used car leasing options for those living in or around Maryland, Virginia & Washington D.C. Visit or call today! With a lease, you're paying to drive the car, not to buy it. That means you're paying for the car's expected depreciation — or loss of value — during the lease. In the most basic terms, vehicle leasing is the rental of a car for a fixed period of time. It's probably obvious, but you can't turn a leased car into any. When you lease a car, you do not own the vehicle. The title is kept by the leasing company, and you'll have specific limits on how you can use the vehicle, how. Starting a Lease · Budget: Budgeting for leasing is about the same as for financing a car. · Determine Your Average Yearly Mileage: As you know, leasing a car. Used car leases are similar to new car leases in a number of ways. Your lease payments are based on the difference between the residual value of the car and its. You'll pay more in the long run for a leased car than you will if you buy a car and keep it for years. You could face excessive wear-and-tear charges. These can. You can lease a car or truck even with a low credit score. Trust the Classic Chevrolet finance department to have your best interests in mind. You do not own the car when you lease. You're paying for the use of the vehicle, but the finance institution that you leased it through actually owns it. This.

Scammers Facebook Marketplace

If you see something you think is a scam, you should stop communicating with the buyer or seller and report the suspected scam to Facebook. Double-check deals. This blog post will outline the warning signs of scams and provide practical tips to avoid falling victim to them. Learn how to report a scam on Marketplace. We compiled a list of tips and resources to help you spot these scammers from the start and keep your money, personal identity, and privacy safe. Learn how to report a scam on Marketplace. Report a Facebook Marketplace buyer. This feature isn't available on mobile browsers, but it is available on these devices. There are a number of different ways fraudsters can try to scam you via Facebook Marketplace, whether you are a buyer or a seller. Here are some of the most. Report a Facebook Marketplace buyer · 1. From your News Feed, in the left menu, click Marketplace. · 2. Click Your Account. · 3. Click Your Listings. · 4. Click a. Common scams on Facebook Marketplace include fake listings, where scammers advertise products they don't have, phishing attempts to obtain. If you see something you think is a scam, you should stop communicating with the buyer or seller and report the suspected scam to Facebook. Double-check deals. This blog post will outline the warning signs of scams and provide practical tips to avoid falling victim to them. Learn how to report a scam on Marketplace. We compiled a list of tips and resources to help you spot these scammers from the start and keep your money, personal identity, and privacy safe. Learn how to report a scam on Marketplace. Report a Facebook Marketplace buyer. This feature isn't available on mobile browsers, but it is available on these devices. There are a number of different ways fraudsters can try to scam you via Facebook Marketplace, whether you are a buyer or a seller. Here are some of the most. Report a Facebook Marketplace buyer · 1. From your News Feed, in the left menu, click Marketplace. · 2. Click Your Account. · 3. Click Your Listings. · 4. Click a. Common scams on Facebook Marketplace include fake listings, where scammers advertise products they don't have, phishing attempts to obtain.

It is % online popular scam that involves Facebook 23street.ruunately, once the funds are given, the criminal scammer will use the funds on the right. Report a Facebook Marketplace buyer · 1. From your News Feed, in the left menu, click Marketplace. · 2. Click Your Account. · 3. Click Your Listings. · 4. Click a. Scams come in different forms, so it's important to know what scams are, and how to recognize them when buying and selling on Marketplace. The latest scam involves them sending you an email asking for more money to 'upgrade' your account before you can accept their payment. The latest scam involves them sending you an email asking for more money to 'upgrade' your account before you can accept their payment. Facebook Marketplace scammers pose as both fake sellers and fake buyers to steal your identity. Learn how to safeguard your identity from Marketplace scams. A scammer will contact you about your listing and tell you that their friend or relative is interested in your item, adding that the friend doesn't use Facebook. Oftentimes the scam is one we've seen before but made new using this new service. Here are Facebook Marketplace scams to be aware of: Fake home and apartment. I have tried to buy a second hand Nintendo Switch for months on Facebook Marketplace. Every seemingly good deal inevitably turns out to be a scam. The Better Business Bureau recently issued a warning to sellers on Facebook Marketplace of Zelle scams; fraudsters attempt to purchase. To report a scam by a seller on Marketplace: 1. From your Feed, in the left menu, click Marketplace. 2. In the left menu, click Buying. 3. Click the listing of. Scammers have recently been using Facebook Marketplace to swindle buyers and sellers alike. Learn about some of their schemes and how you can avoid falling. A big red flag proving that someone could be a scammer is if they don't have many friends, pictures, or posts on their profile page. Here are the top eight Facebook Marketplace scams to avoid, as well as how to recognize red flags. Here are the six most common car buying scams to look out for: 1. Fake profile scam 2. Gift card payment scam 3. “Just needs” scam 4. Deposit scam 5. Phone. A common scam is when a buyer claims they have overpaid for the item and even has transaction proof. They will then demand to be refunded. We compiled a list of tips and resources to help you spot these scammers from the start and keep your money, personal identity, and privacy safe. This group is for everyone selling or buying on the marketplace. Feel free to share! But more important- make sure you are reporting them to Facebook! You could end up sending scammers money for fake items. Scammers post fake ads and Marketplace deals that entice victims to use outside payment platforms on. Here's a guide to some of the most common Facebook Marketplace scams — and how you can protect yourself as both a buyer and a seller.

Internet Real Estate Services

For over 45 years, we've set the gold standard in real estate. Our website is a one-stop resource for your online real estate research. The data relating to real estate for sale on this web site comes in part from the Internet Data eXchange (IDX) of the Multiple Listing Service. Real estate. Find your next residential or commercial property with Canada's largest real estate website - 23street.ru Our complete database of real estate listings will. Berkshire Hathaway HomeServices serves buyers and sellers of the Greater New York real estate market with unparalleled experience and innovative resources. You can now find all of your solutions for showing management tools under one streamlined suite of real estate technology products and services at. CBRE is the global leader in commercial real estate services and investments. Some of the primary Internet real estate platforms include Zillow, Trulia, Yahoo! Real Estate, Redfin and 23street.ru Your resource for all things Real Estate. Including Legal, Agent & Broker, and Property Rights Issues. Whether you're a new agent or an experienced broker you. Internet Real Estate · DigiVie offers Domain Registration & DNS Services and Web Site Hosting to our clients as “value-added” services. · Latest News · Company. For over 45 years, we've set the gold standard in real estate. Our website is a one-stop resource for your online real estate research. The data relating to real estate for sale on this web site comes in part from the Internet Data eXchange (IDX) of the Multiple Listing Service. Real estate. Find your next residential or commercial property with Canada's largest real estate website - 23street.ru Our complete database of real estate listings will. Berkshire Hathaway HomeServices serves buyers and sellers of the Greater New York real estate market with unparalleled experience and innovative resources. You can now find all of your solutions for showing management tools under one streamlined suite of real estate technology products and services at. CBRE is the global leader in commercial real estate services and investments. Some of the primary Internet real estate platforms include Zillow, Trulia, Yahoo! Real Estate, Redfin and 23street.ru Your resource for all things Real Estate. Including Legal, Agent & Broker, and Property Rights Issues. Whether you're a new agent or an experienced broker you. Internet Real Estate · DigiVie offers Domain Registration & DNS Services and Web Site Hosting to our clients as “value-added” services. · Latest News · Company.

Find commercial real estate services and property investment strategies. We work with owners, tenants and investors in the local, national and global. service, integrity, and passionate expertise for your international luxury real estate needs. web site comes in part from the Internet Data Exchange. Make your IDX website a real estate marketing machine! Innovative property search, lead capture, email marketing, and CRM. Try it free! Use CENTURY 21 to find real estate property listings, houses for sale, real estate agents, and a mortgage calculator. We can assist you with buying or. Discover the power of InCom's customizable, fully-featured websites and real estate internet marketing solutions built for Agents and Brokerages. A global commercial real estate services leader, we will never settle for the world that's been built, but relentlessly drive it forward. As one of the largest real estate websites in the country, 23street.ru is jam-packed with information for homebuyers, renters, sellers, and agents. Each listing. In , 97% of homebuyers used the internet in their home search. With social distancing and health guidelines coming from the COVID pandemic, technology. The data relating to real estate listings on this website comes in part from the Internet Data Exchange (IDX) program of Multiple Listing Service of Southern. In my rural area even the service providers maps are unreliable as they only have general availability. I know of one house where they are. Learn about our solutions: Asset Advisory Services, Capital Markets, Landlord Representation, Occupier Representation, Appraisal and Tax, Property Sales. offices and companies. Best Real Estate marketing solutions to generate Internet Real Estate leads. Custom Web design, IDX and SEO agent services. Trusted By Million Buyers. Only 23street.ru connects you directly to the person that knows the most about a property for sale, the listing agent. Internet marketing for real estate is the process of promoting your services to potential leads and converting them to clients. Research NYC commercial and residential properties · Need comprehensive property data in record time? · Owner Names & Contact Details · Foreclosure Listings. An electronic version of the real estate industry, Internet real estate is the concept of publishing housing estates for sale or rent online. New York State MLS aims to provide real estate professionals based in New York a different way to market real estate listings with a state wide MLS. Need an agent? Great! We can help you find the perfect real estate agent based on local market data to help you achieve your goals. Third Party SitesOnce upon a time, listings were only available for licensed agents to view! Now, thanks to the advent of third-party real estate sites like. Embark on a journey through SERHANT.'s meticulously curated properties. Step into a realm where excellence and innovation in global real estate awaits.

Short Term Savings Investments

:max_bytes(150000):strip_icc()/Shorterminvestments_final-47c4f8852ab945b0b940c79d8efdc3bc.png)

Some of the best short-term investment options include short-dated CDs, money market accounts, high-yield savings accounts, government bonds, and Treasury bills. Mutual funds. Pool your money with the money of other investors to purchase tens or hundreds of different stocks, bonds or other investments. As the fund's. Examples of short-term investments include CDs, money market accounts, high-yield savings accounts, government bonds and Treasury bills. These investments. What are the best strategies for short-term investments · High-yield savings accounts (HYSA) · Certificates of deposit (CDs) · Money market accounts (MMA). Once you have saved money to meet emergency needs, consider investing other savings to grow your money. Think about your short and long-term goals. It is. Common options include Fixed Deposits (FDs), Recurring Deposits (RDs) and Short-term Savings Accounts. Short-Term Investments can reach maturity in under a. Banker's acceptances (BA) are short-term credit investments created by non-financial companies and guaranteed by a bank. They are traded at a discount to face. Rather than keeping money in a checking account or savings account where its value will actually decrease (due to inflation), short term investing provides the. Money-market funds are a particular type of mutual fund that is required by law to invest in low-risk, short term securities. Money-market shares can be bought. Some of the best short-term investment options include short-dated CDs, money market accounts, high-yield savings accounts, government bonds, and Treasury bills. Mutual funds. Pool your money with the money of other investors to purchase tens or hundreds of different stocks, bonds or other investments. As the fund's. Examples of short-term investments include CDs, money market accounts, high-yield savings accounts, government bonds and Treasury bills. These investments. What are the best strategies for short-term investments · High-yield savings accounts (HYSA) · Certificates of deposit (CDs) · Money market accounts (MMA). Once you have saved money to meet emergency needs, consider investing other savings to grow your money. Think about your short and long-term goals. It is. Common options include Fixed Deposits (FDs), Recurring Deposits (RDs) and Short-term Savings Accounts. Short-Term Investments can reach maturity in under a. Banker's acceptances (BA) are short-term credit investments created by non-financial companies and guaranteed by a bank. They are traded at a discount to face. Rather than keeping money in a checking account or savings account where its value will actually decrease (due to inflation), short term investing provides the. Money-market funds are a particular type of mutual fund that is required by law to invest in low-risk, short term securities. Money-market shares can be bought.

Best Short-Term Investments · 1. High-Yield Savings Accounts · 2. Money Market Accounts (MMAs) · 3. Certificates of Deposit (CDs) · 4. Treasury Bills (T-Bills) · 5. Short-term investment examples include: Money market accounts; Savings accounts; Certificates of Deposit; Treasury bills; Government bonds; Peer-to-peer lending. Mutual Funds. Mutual funds are an effective long-term savings vehicle. Mutual funds are a great way to "become an owner, not a loaner." They give average. Investing can bring you many benefits, such as helping to give you more financial independence. As savings held in cash will tend to lose value because. Short-term goals are within a five-year window, while long-term goals are at least five years out. · CDs, money market accounts, and traditional savings accounts. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Best Investments For 3 Months · High-Yield Savings Accounts: These accounts provide a competitive interest rate, allowing your money to grow with the. That's when you move towards safer investments like bonds or bond funds then government paper like treasuries which turns into CDs then savings. A money market account is similar to a traditional savings account in that you can draw from it, albeit a limited number of times each year. However, the. Investment funds The Short Term Investment Pool (STIP) was established in FY76 as a cash investment pool available to all UC fund groups. STIP allows fund. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. Whether you're saving. Money Market Accounts · High-Yield Savings Accounts · Term Certificates or Certificates of Deposit (CDs) · Money Market Mutual Funds · Short-Term Government Bonds. The definition of a short-term investment refers to an instrument that matures within one year from its issuance date. Short-term investments carry low. One of the safest and easiest short-term investment options is a high-yield savings account. They work the same as a standard savings account. You deposit money. Short-Term Investment Plans for 1 Month. Savings Accounts. Liquid Funds · Short-Term Investment Plans for 3 Months. Recurring Deposit. Bank Fixed Deposits. Short-term goals: Less than 3 years · U.S. Treasury Bills · Bank or credit union savings accounts · Stable value funds and money market funds · CDs maturing less. Good for short-term needs. A savings account is the ideal spot for an emergency fund or cash you need within the next three to five years. Good for long-term. long-term goals with your short-term needs. Get started · Learn more. Fidelity Unlike traditional FDIC savings accounts, investment accounts are. 2. Consider short-term instruments. Cash is a desirable asset for managing risk and liquidity and can be appropriate for very short horizons. Within the fixed-. Savings. Investments. Savings accounts. Bonds. Certificates of deposit. Stocks On the other hand, if you are saving for a short-term goal, five years or.

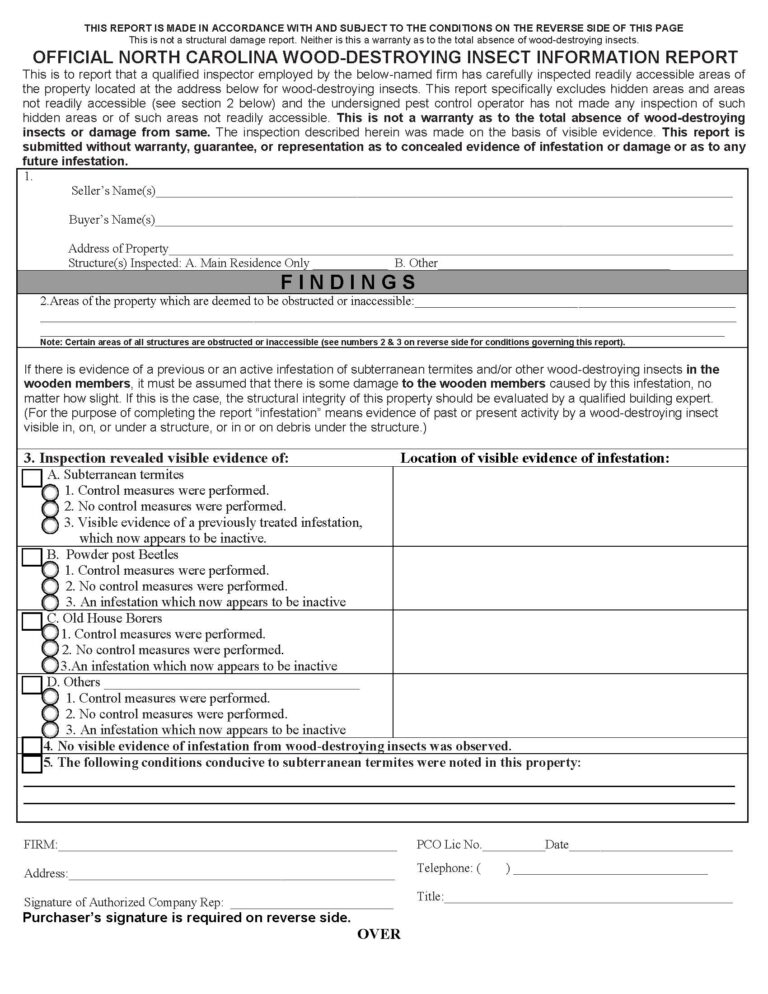

Termite Letter Cost

Nobody likes to talk about money, but when it comes to termite inspections, there's a bit of good news. As a home buyer, you may not be responsible for the cost. Total cost of a termite inspection. The typical cost of termite inspection ranges from $50–, with an average cost of $ Some signs of a termite problem. Initial cost of $1, and maintenance will a little less than $ PSA: If you get a letter in the mail saying you skipped your. Our Murfreesboro pest control experts explain that termite infestations may cost thousands in repairs to fix a home's structure and foundation. The total costs. Type of Clearance Letter Requested(Required). Termite Letter Only. Fungus Letter Only**. Termite & Fungus Letter**. **There Is An Additional Fee For Fungus. Annual termite inspection to make sure there are no new signs of termites; If there are signs of termites, treatment is occasionally at no additional cost; Some. The price of termite inspections varies but can often cost around $ There are different inspection requirements, depending on the type of mortgage and the. Total cost of a termite inspection. The typical cost of termite inspection ranges from $50–, with an average cost of $ Some signs of a termite problem. Nobody likes to talk about money, but when it comes to termite inspections, there's a bit of good news. As a home buyer, you may not be responsible for the cost. Nobody likes to talk about money, but when it comes to termite inspections, there's a bit of good news. As a home buyer, you may not be responsible for the cost. Total cost of a termite inspection. The typical cost of termite inspection ranges from $50–, with an average cost of $ Some signs of a termite problem. Initial cost of $1, and maintenance will a little less than $ PSA: If you get a letter in the mail saying you skipped your. Our Murfreesboro pest control experts explain that termite infestations may cost thousands in repairs to fix a home's structure and foundation. The total costs. Type of Clearance Letter Requested(Required). Termite Letter Only. Fungus Letter Only**. Termite & Fungus Letter**. **There Is An Additional Fee For Fungus. Annual termite inspection to make sure there are no new signs of termites; If there are signs of termites, treatment is occasionally at no additional cost; Some. The price of termite inspections varies but can often cost around $ There are different inspection requirements, depending on the type of mortgage and the. Total cost of a termite inspection. The typical cost of termite inspection ranges from $50–, with an average cost of $ Some signs of a termite problem. Nobody likes to talk about money, but when it comes to termite inspections, there's a bit of good news. As a home buyer, you may not be responsible for the cost.

Noosa Pest Management's Charlotte termite inspection and termite How much does your termite inspection cost? Our initial termite inspections. Termite damage is a serious problem for your home that often goes undetected until it's too late. Call Hughes Exterminators today for a complete free. For a termite inspection report that is part of a home purchase, a connecting one-year warranty which runs $$ may be required, according to one Terminix. The Cost of a Termite Bond in Georgia · Pricing Summary: Retreat bonds, the most popular termite bond option, start at $ and go up depending on the. Termite damage is a serious problem for your home that often goes undetected until too late. Don't delay. Call Arrow Exterminators today for a complete free. Termite inspections are one of the best termite prevention methods. Thankfully a termite inspection is usually not very expensive. In fact, the cost of. Schedule your FREE Termite Inspection with a professional Orkin Pro to Message and data rates apply. Text HELP for help. Text STOP to cancel. The seller has a few choices in how they will handle the expenses of termite and pest control. They can either pay upfront costs for treatment, lower the price. Worried about Termite Inspection Costs? Stop worrying. Book your free termite inspection for your home or business today! () Because of the amount of damage that termites and other wood destroying organisms can do, you can never be too safe. A new home is a big investment and the cost. How Much Does a Termite Inspection Cost and Who Pays? The typical cost of a termite inspection is about $, with a range of $$ Termite treatment. In general, the cost of a termite inspection ranges from $75 to $ Some pest control companies will waive this fee if they are hired on for treatment, but. If you are worried about the added cost of a termite inspection, don't be. At Contractor's Best Pest Solution, we offer a free termite inspection. That's. cost to remove the infestation. A CL termite letter is a pre-inspection that is valid for only 30 days. What Do the Inspectors Look for with the CL Termite inspections usually run between $75 and $, depending on the exterminator. An annual inspection is considered the most effective. The inspection takes. How Much Does a Termite Inspection Cost? Table of Contents: Inspections Explained. Inspection Process. Termite Inspections. Subterranean Termites. Drywood. Order Your Inspection Today! YOUR BUYER FOUND THEIR DREAM HOME - MAKE SURE IT DOESN'T TURN INTO A NIGHTMARE OF COSTLY REPAIRS. A HOME INSPECTION IS A GREAT. These are the specific inspections and documents (aka TERMITE LETTER) that Many agents are misinformed and mistake inspection fees with closing cost. Starting at $, you will receive a full termite inspection and the corresponding report. The technician then examines the property for signs of wood-. VA Loan Termite Inspection Costs. Historically, most VA loan borrowers weren't allowed to pay for termite inspections as part of their home purchase. However.

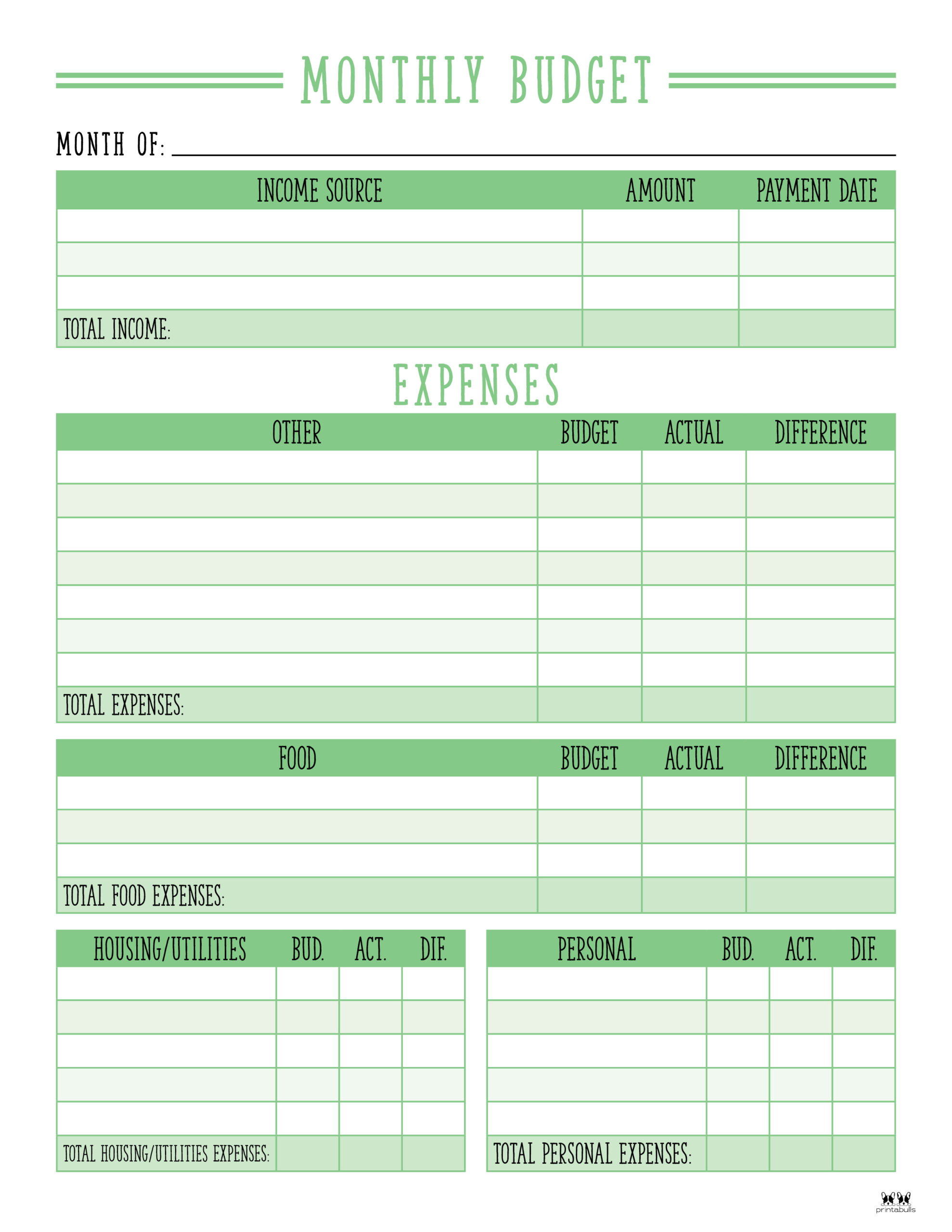

Monthly Budget Plan Example

Groceries, eating out, gifts, clothes, and gas are examples of these types of expenses. Estimate how much you spend on these each month. Looking at past credit. Observing how you spend money can be an eye-opener that helps you save more. Add your wages and other income in the spaces provided. At the end of the month. PERSONAL MONTHLY BUDGET TEMPLATE. If you're looking for a personal monthly budget planner, your searches end here. Since we all are used to tracking our income on a monthly basis, it's obvious. Use this budget tool to see how much you make and spend each month. 1 List your income. 2 List your expenses. 3 Subtract your total spending from total income. Monthly Budget Calculator · Housing & Utilities. Rent or Mortgage · Transportation. Car Payment · Food & Groceries. Groceries & Household Goods · Health & Beauty. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. Choose the right budget template. · Review and modify income sources. · Customize expense categories. · Set realistic budget limits. · Track and monitor your. Discover your monthly financial flow with this intuitive budgeting template. Simply list all your income sources and their amounts in the Income table. Groceries, eating out, gifts, clothes, and gas are examples of these types of expenses. Estimate how much you spend on these each month. Looking at past credit. Observing how you spend money can be an eye-opener that helps you save more. Add your wages and other income in the spaces provided. At the end of the month. PERSONAL MONTHLY BUDGET TEMPLATE. If you're looking for a personal monthly budget planner, your searches end here. Since we all are used to tracking our income on a monthly basis, it's obvious. Use this budget tool to see how much you make and spend each month. 1 List your income. 2 List your expenses. 3 Subtract your total spending from total income. Monthly Budget Calculator · Housing & Utilities. Rent or Mortgage · Transportation. Car Payment · Food & Groceries. Groceries & Household Goods · Health & Beauty. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. Choose the right budget template. · Review and modify income sources. · Customize expense categories. · Set realistic budget limits. · Track and monitor your. Discover your monthly financial flow with this intuitive budgeting template. Simply list all your income sources and their amounts in the Income table.

Explore professionally designed budget templates you can customize and share easily from Canva.

A monthly budget is a financial tool designed to set spending limits and record how your money is being spent within these limits. Not only can you see if you'. 1. Expense tracker · 2. "50/30/20" savings template · 3. Annual income vs expense template · 4. Food budget template · 5. Debt snowball template. Template Monthly Budget Planner. INCOME. MONTHLY £. Your Net Salary / Income. Your Partner's Net Salary / Income. Child Benefit. Tax Credits. Pension. Other. 1. Housing or Rent · 2. Transportation and Car Insurance · 3. Travel Expenses · 4. Food and Groceries · 5. Utility Bills · 6. Cell Phone · 7. Childcare and School. This template gives you a close look at your household's planned versus actual income and details expenses for individual categories on a monthly basis. 80% of your current annual income for each year of retirement. For tips on planning for retirement, visit 23street.ru Regular Expenses. Food. While they look at a typical month's spending, what about birthdays, that tooth filling you have to pay for and other one-offs? This guide gives you some. Budgets should use monthly figures because most important bills are monthly. Try our free budget template (Excel file or PDF). Screen readers cannot read. 1. Calculate your net income. The first step is to find out how much money you make each month. · 2. List monthly expenses. Next, you'll want to put together a. Monthly Budget Planner ; Income. Total Net Income. Other Income ; Housing and Living Expenses. Mortgage or Rent. Homeowners/Renters Insurance. Property Taxes. Use this worksheet to see how much money you spend this month. Then, use this month's information to help you plan next month's budget. Choose the right budget template. · Review and modify income sources. · Customize expense categories. · Set realistic budget limits. · Track and monitor your. By writing down your monthly income and expenses, you can see how much money you expect to have for the month and plan for how much you can spend. The First. Savings 20% $2, Values are based on a monthly budget. Congratulations, you're off to a great start! Your 50/30/20 budget is a simple rule of thumb that can. Our free budget calculator will help you to know exactly where your money is being spent, and how much you've got coming in. Knowing how to manage a budget. Once you've added the finishing touches to your budget template, save it to your devices or print it out. Discover monthly budget templates, household budget. If your purchases vary from month to month — but you still want to stay on your intended spending course — the Simple Monthly Budget Template can steer you in. What is a Monthly Budget? Definition: A monthly budget is a financial plan outlining a specific month's income, expenses, and savings. It itemizes anticipated. By writing down your monthly income and expenses, you can see how much money you expect to have for the month and plan for how much you can spend. The First. - A monthly budget worksheet with the same categories as the family budget planner. month cash flow plan (i.e. budget). Account Register Template.